December 2019

Being Unreserved: About the Reserve Bank Archives

The Reserve Bank of Australia has a unique and rich archives. In addition to records about the nation’s central bank, the archives contain records about Australia’s economic, financial and social history over almost two centuries. The extent of the collection reflects the Bank’s lineage, with its predecessor (the original Commonwealth Bank of Australia) having absorbed banks with a colonial history. Consequently, the Bank’s archival collection spans convict banking records through to information about contemporary episodes in Australia’s history. This article explains why the archives exist, how they are managed and plans to make them more accessible to the public.

How Do Global Financial Conditions Affect Australia?

Australia is closely integrated with global capital markets. This integration has been of benefit to the economy, but also means that Australian financial conditions are influenced by developments abroad. The flexible exchange rate regime partially insulates the economy from global financial conditions. In particular, that flexibility means that monetary policy in Australia does not need to move in lock step with policies of the major central banks. However, to meet its objectives for employment and growth, the Reserve Bank can choose to offset pressure on the exchange rate from shifts in foreign monetary policies. Indeed, for much of the past decade or so, forces underpinning the structural decline in global risk-free rates have placed downward pressure on interest rates offshore and in Australia. International investors’ willingness to take risk also has an important bearing on domestic financial conditions.

A Cost-benefit Analysis of Polymer Banknotes

Australia was the first country to issue a full series of polymer banknotes, completed over 1992–96. After 25 years, issuance of the second generation of polymer banknotes is well advanced. It seems appropriate, therefore, to revisit the financial savings resulting from the switch to polymer. Employing a cost-benefit analysis framework, we find that the switch to polymer has resulted in net savings of close to $1 billion over the past 25 years in inflation-adjusted terms. This does not take account of the benefits of reduced counterfeiting, which have also been substantial and were the original motivation for switching to polymer. We also discuss cost savings arising from outsourcing banknote distribution to the private sector, as well as seigniorage income which accrues from banknotes on issue and which ultimately flows to the Australian Government as non-tax revenue in the form of the dividend payment from the Reserve Bank.

Long-term Growth in China

Slowing trend growth in China, and the risks around this trajectory, are relevant to the future economic prospects of its major trading partners, including Australia. This article provides a long-term perspective on growth in China, beginning with a review of historical trends. It then examines the drivers of growth since reforms were introduced in the late 1970s and how these drivers are affecting the growth outlook. The article concludes that a range of structural headwinds will constrain growth in the coming decade, posing challenges for policymakers.

Potential Growth in Advanced Economies

Potential growth is the rate of growth that an economy can sustain over the medium term without generating excess inflation. Potential growth has declined in the advanced economies in recent decades due to lower growth in the labour force, capital stock and productivity. Current projections and long-term growth expectations suggest that the low rates of potential growth in advanced economies will persist for some time.

The Nature of Australian Banks' Offshore Funding

Australian banks access large and deep foreign funding markets to supplement their domestic funding. Looking at the major banks’ worldwide operations, such offshore funding accounts for about one-third of their assets. This funding is raised in a variety of ways, across several countries and by various entities within the banking groups. While offshore funding can create vulnerabilities, these are appropriately mitigated by various factors. It would nonetheless be desirable for banks to continue to lengthen the maturity of their offshore debt securities.

Conditions in China's Corporate Sector

Revenue and profit growth have slowed in China’s corporate sector in recent years, alongside a broader moderation in China’s economic momentum. The slowdown has been most severe for labour-intensive private companies, particularly export-oriented manufacturing firms. The government has responded by announcing a range of measures aimed at easing financial conditions faced by the private sector. Earlier efforts by the Chinese authorities to reduce risks in China’s financial system appear to have been successful in stabilising leverage in the state-owned sector, but the financial position of private sector firms is more fragile, and risks remain elevated in the real estate industry.

Developments in Foreign Exchange and Over-the-counter Derivatives Markets

Global activity in foreign exchange (FX) and over-the-counter (OTC) derivatives markets

increased over the three years to April 2019.

Continuing a trend observed over prior years, growth in turnover of foreign exchange

derivatives outpaced growth in spot market activity. Trading between dealers

and other financial institutions accounted for a larger share of market activity

than trading between FX dealers.

The Australian dollar remained the fifth most traded currency globally, although

the volume of FX trading activity in the Australian market was little changed.

Over the past three years, the growth of global and Australian OTC derivatives

markets has been driven by interest rate derivatives.

September 2019

The Committed Liquidity Facility

The Reserve Bank provides the Committed Liquidity Facility (CLF) as part of global reforms to improve the resilience of the banking system. The CLF is required due to the low level of government debt in Australia. This limits the amount of high-quality liquid assets that financial institutions can reasonably hold as a buffer against periods of stress. Under the CLF, the Reserve Bank commits to providing a set amount of liquidity to institutions, subject to them satisfying several conditions. These include having paid a fee on the committed amount. No financial institution has needed to draw upon the CLF in response to a period of financial stress.

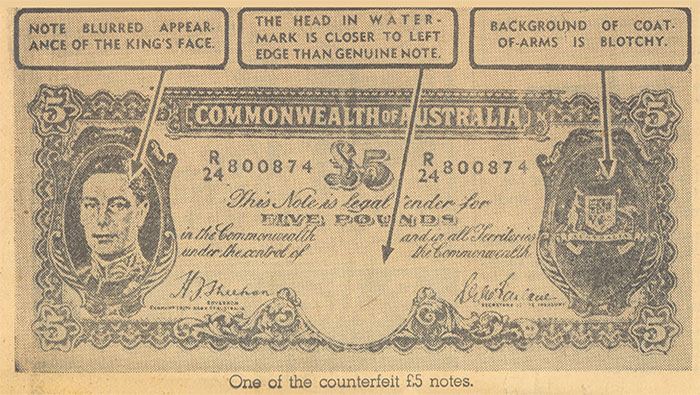

A Brief History of Currency Counterfeiting

The crime of counterfeiting is as old as money itself, and can be targeted at both low- and high-value denominations. In most cases, counterfeiting is motivated by personal gain but, at times, it has also been used as a political weapon to destabilise rival countries. This article gives a brief history of counterfeiting, with a particular focus on Australia, highlighting selected incidents through time and the policy responses to them. For source material on Australia, we draw on Reserve Bank archives dating back to the early 1900s.

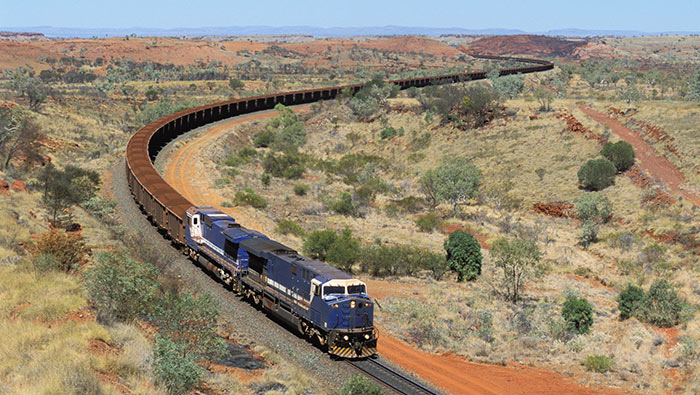

Education Choices and Labour Supply During the Mining Boom

The mining boom led to large increases in wages for many lower-skilled jobs in mining regions. This raised the opportunity cost of remaining in school, TAFE or university for many students, particularly those in mining areas. I show that this led fewer people in those areas to pursue tertiary study. These educational responses were an important source of labour market adjustment during the boom. It accommodated most of the strong rise in the labour force participation rate of 15–24 year olds in the resource-rich states, and 5–10 per cent of the total additional labour supply needed in those states.

The Changing Global Market for Australian Coal

Coal is one of Australia’s largest exports, and has accounted for around one-quarter of Australia’s resource exports by value over the past decade. However, demand in the global market for coal has been evolving in recent years, which is creating some uncertainties for the longer-term outlook for coal exports. Looking forward, demand will be shaped by the speed of the transition towards renewable energy sources, changing steel production technologies, and the pace of global economic growth. Over the next few years, Australian coal production and exports are expected to grow fairly modestly.

Liberalisation of China's Portfolio Flows and the Renminbi

China’s equity and bond markets have grown rapidly to be among the largest in the world, yet, until recently, participation by foreign investors has been limited. Over recent decades, the Chinese authorities have relaxed investment restrictions to allow greater foreign access to these capital markets. This has enabled greater foreign investment and for global equity and bond index providers to increase the weight of Chinese securities in their indices, which are tracked by a range of global investment funds. These developments have contributed to an increase in gross foreign capital flows into China and they are likely to continue to support inflows in the period ahead. At the same time, an increase in Chinese resident portfolio outflows is also likely as domestic investors seek to diversify by investing abroad. The opening of China’s financial markets entails benefits associated with deeper global financial integration, but may also contribute to greater variability in the renminbi.

Bank Balance Sheet Constraints and Money Market Divergence

The spread between key Australian money market interest rates has widened and become more volatile in recent years. While this might seem to imply scope to profit from arbitrage – by borrowing at a low rate to invest at a higher one – banks have additional balance sheet considerations that need to be taken into account. We find that money market trades have generally not been profitable for the four major banks since the financial crisis. This is partly because debt funding costs have fallen by less than money market returns. In addition, equity funding, which is more expensive than debt, has increased. Consequently, the incentive for banks to arbitrage between money market interest rates has fallen. We also note that banks tend to prefer more profitable lines of business, such as lending for residential housing, over the narrow margins implied by money market arbitrage.

Survival Analysis and the Life of Australian Banknotes

The Reserve Bank is in the process of replacing Australia’s first full series of polymer banknotes – the ‘New Note Series’ – with the upgraded ‘Next Generation Banknote’ series. This presents a good opportunity to review our experience with polymer banknotes, and in particular, examine how they have worn in practice. To do so, I extend an existing survival modelling approach to estimate how long a given polymer banknote from the ‘New Note Series’ might be expected to last when in use by the general public. I find that $5 and $10 banknotes have tended to last for around 5 years on average, while $20 and $50 banknotes have lasted for 10 and 15 years on average, respectively. I have not modelled $100 banknotes as they are overwhelmingly used for store-of-value purposes and so do not tend to wear out.

June 2019

The Framework for Monetary Policy Implementation in Australia

The Reserve Bank of Australia's domestic market operations are designed to ensure that the cash rate is consistent with the target set by the Reserve Bank Board. The most important tools to guide the cash rate to the target are the interest rate corridor and daily transactions to manage liquidity in the interbank overnight cash market. The RBA also ensures that there is sufficient liquidity in the cash market for it to function smoothly. This article provides an overview of the RBA's operational framework for implementing monetary policy.

Cash Withdrawal Symptoms

Most Australians don't have to travel more than a few kilometres to deposit or withdraw cash. Cash use is declining, however, and with it the number of ATMs and other cash access points. This trend seems likely to continue. While it will probably have relatively little impact on those living in metropolitan areas, it is important that reasonable access to cash services is maintained for people in regional or remote locations as long as such access is needed.

Bank Fees in Australia

The Reserve Bank has conducted a survey on bank fees each year since 1997. Banks' overall income from fees was little changed in 2018. The removal of ATM withdrawal fees by a number of banks reduced total fees charged to households. However, this was largely offset by the continued increase in fee income from small businesses, reflecting strong growth in credit card and debit card transactions.

A Decade of Post-crisis G20 Financial Sector Reforms

The global financial crisis resulted in significant disruption to markets, financial systems and economies. It also led to comprehensive reform of the financial sector by the G20 group of countries. After a decade of policy design and implementation, standards in the global financial system and regulatory approaches in many countries have changed substantially to improve financial system resilience. Australia, as a G20 member, has been active in implementing these reforms. This article looks at the main financial sector reforms developed in the immediate post-crisis period, their implementation in Australia and the more recent shift in international bodies' focus to assessing whether these reforms have met their intended objectives.

Wages Growth by Pay-setting Method

Using job-level micro data, we show that the dynamics of wages growth differ across pay-setting methods. In recent years, wages growth has been strongest for award-reliant workers, stable at low levels for those on enterprise bargaining agreements (EBAs), and low but rising for those on individual arrangements. These trends reflect differences in the arrangements governing each pay-setting method, and differences in the types of workers covered by them. For instance, individual agreements react most flexibly to changes in labour market spare capacity, while government policies have kept public sector wages growth in EBAs relatively unchanged of late. This new disaggregation of wages growth allows for an estimation of the pass-through of award wage increases to other wage outcomes in the economy. We also find that the new breakdown provides a useful framework for forecasting aggregate wages growth.

Spillovers to Australia from the Chinese Economy

China is Australia's largest trading partner. The strong links between the two economies raises the question of how a sizeable slowdown in Chinese activity would affect Australia. Through our research we have attempted to quantify how such a scenario could play out and its implications. We consider the main transmission channels, notably trade and financial market effects, and describe possible scenarios that could lead to a material slowing in China. We apply a stylised shock encapsulating features of these scenarios to a medium-sized macroeconometric model of the Australian economy and analyse how the shock is transmitted through real and financial channels. The potential for the exchange rate and monetary policy to offset some of those effects is also examined.

Competition and Profit Margins in the Retail Trade Sector

Net profit margins have declined for both food and non-food retailers over recent years. This has been driven by a decline in gross margins suggesting a reduction in firms' pricing power. This is consistent with information from the Reserve Bank's business liaison program about heightened competition in the retail trade sector. Liaison indicates that firms are seeking to offset the decline in margins through measures such as vertically integrating supply chains and adjusting product mixes. Retailers also report a push to reduce operating expenses such as rent and labour, though with mixed success.

Can Structural Change Account for the Low Level of Non-mining Investment?

No, it cannot. Non-mining firms have invested less over the past decade, relative to their output, than they did over the previous two decades, and this decline in investment intensity has been broad based across firms. This reduced investment could contribute to slower economic growth, if, for example, it is associated with decreased adoption of new technologies. This article looks into potential driving forces behind the decline in the rate of investment, finding that it cannot be explained by shifts in industry structure, or the composition of firms by age or date of formation. The size of the decline is consistent with what would be expected given slower technological progress and lower depreciation rates. But there might be other, more cyclical reasons for the observed slowdown in non-mining investment.

Explaining Low Inflation Using Models

The Reserve Bank's inflation forecast models can help assess which factors have contributed most to low inflation over recent years. The models find that spare capacity in the economy and the associated low wages growth can account for much of recent low inflation outcomes. This article outlines the inflation forecast models used at the Bank, and looks at the recent performance of the Bank's inflation forecasts.

The Australian Equity Market over the Past Century

This article describes developments in the Australian equity market over the past century, drawing in part from a newly compiled historical dataset which begins in 1917. Over the past one hundred years, the market has increased in size relative to the economy, while its composition by industry also changed substantially. The data also provide new evidence that historical returns on Australian equities – and therefore the equity risk premium – are lower than previously thought.

China's Local Government Bond Market

China's local government bond market is a key source of financing for local governments, particularly to fund infrastructure investment. The market has grown rapidly in recent years but is still relatively illiquid and has a narrow investor base. It also shows little difference in pricing of credit risk across different bond types and issuers, partly due to the perception that local governments enjoy an implicit guarantee from the central authorities. The Chinese Government has implemented measures to foster the development of these features of the market, bearing in mind risks to financial stability.

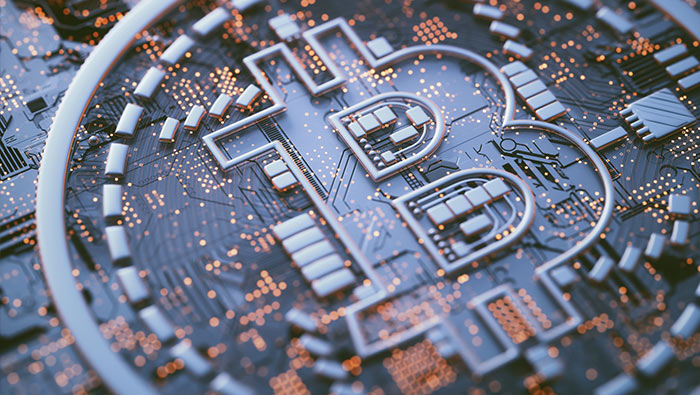

Cryptocurrency: Ten Years On

Ten years on from the creation of Bitcoin, the term ‘cryptocurrency' has entered the public consciousness. Despite achieving some name recognition, cryptocurrencies are not widely used for payments. This article examines why Bitcoin is unlikely to become a ubiquitous payment method in Australia, and summarises how subsequent cryptocurrencies have sought to address some of the shortcomings of Bitcoin – such as its volatility and scalability problems. It also examines the proliferation of new ‘coins' and concludes that, despite the developments in cryptocurrencies, none are currently functioning as money in the economy.

Exploring the Supply and Demand Drivers of Commodity Prices

Quantifying the relative importance of supply and demand in price movements of commodities can help inform how changes in these prices might impact the Australian economy, via exports, business investment and the exchange rate. Isolating the extent to which a change in commodity prices is driven by demand also provides a timely indicator of global economic activity. In this article, we use a dynamic factor model to help interpret changes in commodity prices as being driven by supply and/or demand developments. Results from the model are consistent with prior understanding of several notable episodes of commodity prices movements.

March 2019

New Payments Insights from the Updated Retail Payments Statistics Collection

The Reserve Bank has significantly expanded the retail payments data that it publishes from 61 to around 300 series. This followed a project conducted in consultation with the industry to update the underlying statistical collection. The new data provide additional insights into Australians' payment behaviours, particularly in the context of the shift towards electronic methods of payment away from cash and cheques. This article discusses some of the new series being published by the Bank.

Developments in Banks' Funding Costs and Lending Rates

Banks' funding costs increased a little over 2018, driven by a rise in the cost of wholesale funding linked to money market rates, but with some offset from reductions in the cost of retail deposits. Most lenders passed the increase in funding costs through to their lending rates, including for mortgages. Nevertheless, funding costs and lending rates remain low by historical standards.

Updates to Australia's Financial Aggregates

The financial aggregates for Australia are important data compiled by the Reserve Bank that are used by policymakers to assess financial and economic activity of households and companies. From August 2019, the Reserve Bank will publish the financial aggregates using an improved framework based on a better data collection. This will enhance the quality of information available to policymakers and the wider community. This article gives an overview of the main changes.

Recent Trends in Banknote Counterfeiting

Law enforcement intervention has shut down several large counterfeiting operations and led to a decline in counterfeiting rates over the past couple of years. At the same time, the increased availability of low-cost, high-quality printing technology has meant that the quality of counterfeits has improved. This article discusses trends in banknote counterfeiting in Australia and the impact of counterfeiting on different stakeholders.

The Labour and Capital Shares of Income in Australia

In Australia, the share of total income paid to workers in wages and salaries (the ‘labour share’) rose over the 1960s and 1970s but has gradually declined since then. The corollary is that the share of income going to capital owners in profits (the ‘capital share’) has risen. The long-run increase in the capital share largely reflects higher returns accruing to owners of housing (primarily rents imputed to home owners, particularly before the 1990s) and financial institutions (since financial deregulation in the 1980s). Estimates of the capital share of the financial sector are affected by measurement issues, though structural factors, such as a high rate of investment in information technology, have reduced employment and increased capital in the sector.

Wealth and Consumption

Do households consume more when their wealth increases? Our research identifies a positive and stable relationship between household wealth and consumption, largely reflecting changes in spending on motor vehicles, durable goods and other discretionary spending. Increases in household wealth supported household spending between 2013 and 2017, when growth in disposable income was weak. Similarly, declines in household wealth typically weigh on consumption. However, a decline in household wealth is less likely to coincide with weaker consumption growth if it occurs at a time when the labour market is strong and household income growth is firm.

Firm-level Insights into Skills Shortages and Wages Growth

Despite increased reports of skills shortages from contacts in the RBA's regional and industry liaison program since 2016, national wages growth has picked up only a little and remains subdued. Information collected through the liaison program since the early 2000s suggests Australian firms use a range of practices in addition to, and sometimes before, increasing wages to address skills shortages. In the short run, this may constrain the effect of skills shortages on wages growth.

The International Trade in Services

Services are becoming increasingly traded globally and technological advances have led to the rise of more modern services such as communications, financial and intellectual property services. While advanced economies continue to account for the bulk of the demand and supply of services traded around the world, the emerging economies' share has been increasing. This article examines the changing global trends and compares them to Australia's experience with services trade, which has been shaped by China's growing demand.

Housing Policy and Economic Growth in China

Housing investment has contributed significantly to Chinese GDP growth in recent decades and, due to the steel-intensive nature of that investment, has also been an important driver of Australian exports of iron ore and metallurgical coal. Trends in Chinese residential investment have been strongly influenced by government policies. Since 2016, the Chinese Government has tightened policies, particularly towards ‘speculative’ housing purchases, to moderate property price inflation. It has simultaneously implemented targeted, incremental measures to improve longer-term housing supply. Even so, construction activity has weakened and prices have continued to rise rapidly. Maintaining this policy mix towards the sector is likely to prove challenging as downside risks to broader economic conditions mount.

The graphs in the Bulletin were generated using Mathematica.

ISSN 1837-7211 (Online)