Topic: Payments

The Cash-use Cycle in Australia

The use of cash for day-to-day transactions has been declining for many years and this has implications for all aspects of the cash system. This article illustrates the interrelationships between consumers’ use of cash for transactions, access to cash services and merchants’ acceptance of cash as a payment mechanism through a ‘cash-use cycle’. Recent data suggest that the cash-use cycle in Australia is functioning adequately at present. However, the ongoing adequacy of cash access is vulnerable to further withdrawal of access points; this issue warrants regular monitoring.

Bank Fees in Australia

This article updates previous Reserve Bank research on bank fees charged to Australian households, businesses and government. Over the year to June 2022, total fees charged by banks through their domestic operations were little changed from the previous reporting period. Strong growth in business credit added to fee income in the year, while overall fee income from households declined amid heightened lending competition in the housing market. Lending growth continued to outpace growth in fee earnings, and total fee income as a share of banks’ incomes decreased slightly.

Reassessing the Costs and Benefits of Centrally Clearing the Australian Bond Market

This article considers the costs and benefits of centrally clearing the Australian bond market, in light of developments in the market since the Reserve Bank’s last review in 2015. On balance, our analysis suggests that changes to the size and structure of the Australian bond market have strengthened the case for central clearing. These changes include substantial growth in the size of the market, increased participation of non-resident investors and increased complexity resulting from the growing number of bilateral clearing arrangements. Central clearing would simplify the market structure and could yield other benefits, especially in times of stress. For example, our estimates suggest multilateral netting has the potential to lower settlement obligations by $60 billion per day. This is more than can be achieved with bilateral netting. Further, market resilience and liquidity conditions might also be improved by multilateral netting as interbank participants’ balance sheet constraints are reduced. The key challenge for a potential central counterparty would be to develop a sufficiently wide network of products and participants to achieve overall benefits. Some participants face a lower incentive to join and in their absence the potential benefits from central clearing would be reduced.

Stablecoins: Market Developments, Risks and Regulation

Stablecoins – a type of crypto-asset designed to maintain a stable value – have grown in popularity over recent years. Market developments, however, have highlighted the risks stablecoins can pose to investors, particularly if they are not fully backed by high-quality liquid assets. Stablecoins currently pose limited risks to the broader Australian financial system, but this could change if they become more widely used in the future – for example, in payments and other financial services. As such, regulators across the world are seeking to bring greater clarity to the regulatory treatment of stablecoins, not only to manage risks but also to support innovation in the market. This article considers the rise of stablecoins, the risks they pose and the response of regulators so far.

The Cost of Card Payments for Merchants

The average cost for a merchant to accept a card payment has declined over recent years. However, consumers are making more payments with cards than ever before, which is raising total payment costs for merchants. Smaller merchants also face notably higher card payment costs per transaction than larger merchants. To strengthen competition and help reduce the cost of accepting card payments, the Reserve Bank wants all merchants to be able to choose which card network is used to process debit transactions – a functionality known as least-cost routing (LCR). While considerable progress has been made, the payments industry has more work to do to provide and promote LCR. The Bank is taking further action to ensure that LCR will be available for all merchants.

What Can You Do With Your Damaged Banknotes?

Through the Reserve Bank's damaged banknote claims service, members of the public can ask for their damaged banknotes to be assessed and the value redeemed. Removing poor-quality banknotes also supports the Bank's aim of ensuring that the public has confidence in Australian banknotes as a means of payment and a secure store of wealth. This article provides an overview of the service, its key users and the circumstances in which claims are lodged. While the value of the majority of claims is relatively low, claims containing banknotes damaged in storage can be significant, reflecting the role of cash as a secure store of wealth.

Recent Trends in Banknote Counterfeiting

Counterfeiting of Australian banknotes is approaching its lowest level in a decade. Several factors are playing a role in this decline, including fewer transactions being made with cash, COVID-19-induced lockdowns, the rollout of a new banknote series with upgraded security features, and law enforcement continuing to interrupt counterfeiting operations. This article quantifies the effect of some of these factors, while exploring the broader trends in banknote counterfeiting.

Bank Fees in Australia

This article updates previous Reserve Bank research on bank fees charged to Australian households, businesses and government. Since 2021, improved data on the fees charged by banks have been available from the new Economic and Financial Statistics collection, which replaced the survey on banks' fee income undertaken annually since 1997 by the Reserve Bank. The new data suggest that the overall fees charged by banks declined in 2021. This decline was broadly based across different categories, although total fees charged on loans (excluding personal lending) increased moderately, in part reflecting the higher volume of lending activity.

The Evolution of Interbank Settlement in Australia

Electronic payments are ubiquitous in modern economies and result in financial obligations between different financial institutions. These interbank obligations need to be settled in a way that is safe and efficient to promote the stability of the Australian financial system. In Australia, interbank settlement is performed in the Reserve Bank Information and Transfer System (RITS), which is owned and operated by the Reserve Bank. Since the introduction of real-time gross settlement services in 1998, the functionality of RITS has continued to evolve in line with payment innovations and the increasing importance that electronic payment systems play in supporting economic activity in Australia. This article considers key moments in this evolution as well as potential future developments.

Bank Fees in Australia During the COVID-19 Pandemic

The Reserve Bank's annual survey of bank fees shows that their fee income from both households and businesses in Australia declined notably over 2020 due to the disruption to economic activity caused by the COVID-19 pandemic.

Review of the NGB Upgrade Program

A key responsibility of the Reserve Bank is to maintain public confidence in Australia's banknotes as a secure method of payment and store of wealth. To help achieve this objective the Bank initiated the Next Generation Banknote (NGB) program, which involved the design and development of a new banknote series to make Australia's banknotes more secure from counterfeiting. The decade-long program concluded in late 2020, with the release of the final upgraded banknote into general circulation. The program delivered a suite of new Australian banknotes with a range of new innovative security features. Overall the banknotes have been well received by the general public and counterfeiting rates have remained low.

How Far Do Australians Need to Travel to Access Cash?

Our analysis finds that Australians generally do not have to travel far to reach their nearest cash access point – a location where they may make cash withdrawals and/or deposits. Around 95 per cent of people live within about 5 kilometres of a cash access point, broadly unchanged since 2017. However, there are parts of regional and remote Australia with limited access to cash. People in these areas must travel longer distances to access cash, and the available access points do not always have nearby alternatives. This means that access to cash in these areas is more vulnerable to any future removal of cash services.

COVID-19 Stimulus Payments and the Reserve Bank’s Transactional Banking Services

The Australian Government introduced significant fiscal support measures to limit the negative economic effects of the COVID-19 pandemic and support economic recovery. In its capacity as the banker to the Commonwealth of Australia, and importantly as transactional banker to the large agencies charged with delivering a number of these measures, the Reserve Bank facilitated the distribution of fiscal stimulus payments to households and businesses. Improvements in government processes to ensure bank account details are available when delivering large-scale economic stimulus programs ensured that the COVID-19 stimulus payments were delivered more quickly and efficiently when compared to the stimulus payments made during the Global Financial Crisis (GFC) in 2008 and 2009. This meant that there was little delay for the economic stimulus to be available to the recipients and the economic support to take effect.

Developments in the Buy Now, Pay Later Market

The buy now, pay later (BNPL) sector is growing rapidly and new providers and business models are emerging. While the development of these new payment services is evidence of Australia's innovative and evolving payments system, it may also raise issues for policymakers. The Reserve Bank is currently considering policy issues raised by BNPL providers' no-surcharge rules as part of its Review of Retail Payments Regulation. This article discusses developments in the BNPL sector, focusing on different business models and implications for the cost of electronic payments to merchants.

Property Settlement in RITS

Property transactions are among the largest and most significant financial undertakings that many Australians enter into. As with other aspects of Australia's economy, innovation and technological change have led to the introduction of electronic solutions for property conveyancing, replacing the traditional paper-based process. To support the shift to electronic conveyancing, in 2014 the Reserve Bank of Australia introduced new functionality in the Reserve Bank Information and Transfer System to enable near real-time settlement of interbank obligations relating to property transactions. This functionality minimises settlement risk for the transfer of property ownership, while also ensuring that the property settlement process remains secure, reliable and efficient.

Cash Demand during COVID-19

Since the onset of the COVID-19 pandemic, the value of banknotes in circulation has risen sharply. This was despite cash being used much less for everyday transactions. Much of the strong demand for banknotes can be attributed to people's desire to hold cash for precautionary or store-of-wealth purposes. This behaviour is common during periods of significant economic uncertainty and stress, and many other countries saw similar patterns of cash demand.

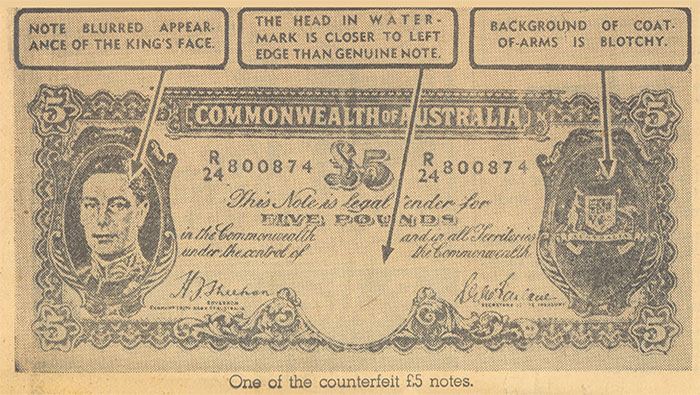

A Counterfeit Story: Operation Gridline

In 2019, the counterfeiters responsible for the production of a group of high quality $50 and $100 counterfeit banknotes were sentenced. From first detection at the Reserve Bank's Counterfeit Examination Laboratory, through police investigation, arrest and finally prosecution and sentencing, this counterfeit episode was resolved reasonably quickly. This experience highlighted the benefits of collaboration between the Bank, federal and state police and legal authorities, and how such a collective effort can be very effective in the disruption of counterfeit production and distribution in Australia.

Modernising Payments Messaging: The ISO 20022 Standard

Electronic payments rely on the exchange of messages to instruct the flow of funds between financial institutions. The quality of payment messaging data is important as it determines what payment information is received by financial institutions and their customers. Worldwide, there is movement to develop new payment systems using the International Organization for Standardization (ISO) 20022 messaging standard, and to migrate some existing systems to the standard. In Australia, an industry-led project to migrate the High Value Payments System to ISO 20022 commenced this year. This will provide a number of benefits, including improved transfer of payment information to beneficiaries, better fraud and financial crime management for payments service providers and greater opportunities for straight-through processing.

Retail Central Bank Digital Currency: Design Considerations, Rationales and Implications

There has recently been increasing international focus on the possible issuance of central bank digital currencies (CBDC), or what might be considered a digital equivalent of banknotes. While the technical feasibility of such a new form of money is not yet established, this paper considers some issues around its possible design, the possible rationales for issuance, and the implications of issuance. Given the likely benefits and risks, at present there does not seem to be a strong public policy case for issuance in Australia. Nonetheless, it will be important to closely watch the experience of other jurisdictions that are considering implementing CBDC projects.

Cash Use in Australia: Results from the 2019 Consumer Payments Survey

The Bank’s 2019 Consumer Payments Survey (CPS) suggests that the use of cash for transactions has continued to fall alongside growing use of electronic payment methods. Despite this, a substantial share of consumers still use cash intensively, with this share having reduced only a little over recent years. These high cash users are more likely to be older, have lower household income, live in regional areas, and/or have limited internet access. The survey suggests that around one-quarter of consumers would face major inconvenience or genuine hardship if they could no longer use cash, although most respondents stated that their current access to cash was convenient. The survey was conducted before the emergence of COVID-19 and the associated social distancing measures, however, and so did not capture any change in behaviour that may have resulted from this.

Bank Fees in Australia

The Reserve Bank’s 23rd annual bank fees survey shows that, overall, banks’ income from fees declined in 2019. Fee income from households decreased, largely driven by lower fees from deposit accounts. A number of reforms related to merchant services contributed to banks’ fee income from businesses growing at a slower pace than in recent years.

Two Years of Fast Payments in Australia

It has been two years since the public launch of the New Payments Platform (NPP) and the Fast Settlement Service (FSS). Together, the NPP and FSS now enable customers of more than 90 financial institutions to make fast payments 24 hours a day, every day of the week (‘24/7’). Customers can send detailed information with a payment and nominate the payment recipient in a simple way. While the rollout of the NPP has been gradual, usage grew rapidly over the second half of 2019 and compares favourably with other successful fast payment systems introduced overseas. With a range of new functionality under development, the NPP and FSS are well placed to deliver innovative new payment services to support the Australian economy into the future.

Consumer Payment Behaviour in Australia

The Reserve Bank’s 2019 Consumer Payments Survey has provided further evidence that Australian consumers are increasingly preferring to use electronic payment methods. Many people now tap their cards, or sometimes phones, for small purchases rather than paying in cash. Consumers also have an increasing range of options available for making everyday payments. Despite this, cash still accounts for a significant share of lower-value payments and a material proportion of the population continues to make many of their payments in cash.

The Cost of Card Payments for Merchants

Data on merchants’ costs of accepting card payments show large differences in payment costs across both merchants and card systems. Smaller businesses typically face higher payment costs than larger businesses, credit card transactions are generally more expensive that debit cards, and debit card transactions tend to be more costly for most merchants when processed through the international card schemes compared with the domestic debit scheme. Overall costs of accepting card payments have nevertheless declined over the past decade, following the implementation of various reforms by the Bank.

A Cost-benefit Analysis of Polymer Banknotes

Australia was the first country to issue a full series of polymer banknotes, completed over 1992–96. After 25 years, issuance of the second generation of polymer banknotes is well advanced. It seems appropriate, therefore, to revisit the financial savings resulting from the switch to polymer. Employing a cost-benefit analysis framework, we find that the switch to polymer has resulted in net savings of close to $1 billion over the past 25 years in inflation-adjusted terms. This does not take account of the benefits of reduced counterfeiting, which have also been substantial and were the original motivation for switching to polymer. We also discuss cost savings arising from outsourcing banknote distribution to the private sector, as well as seigniorage income which accrues from banknotes on issue and which ultimately flows to the Australian Government as non-tax revenue in the form of the dividend payment from the Reserve Bank.

Survival Analysis and the Life of Australian Banknotes

The Reserve Bank is in the process of replacing Australia’s first full series of polymer banknotes – the ‘New Note Series’ – with the upgraded ‘Next Generation Banknote’ series. This presents a good opportunity to review our experience with polymer banknotes, and in particular, examine how they have worn in practice. To do so, I extend an existing survival modelling approach to estimate how long a given polymer banknote from the ‘New Note Series’ might be expected to last when in use by the general public. I find that $5 and $10 banknotes have tended to last for around 5 years on average, while $20 and $50 banknotes have lasted for 10 and 15 years on average, respectively. I have not modelled $100 banknotes as they are overwhelmingly used for store-of-value purposes and so do not tend to wear out.

A Brief History of Currency Counterfeiting

The crime of counterfeiting is as old as money itself, and can be targeted at both low- and high-value denominations. In most cases, counterfeiting is motivated by personal gain but, at times, it has also been used as a political weapon to destabilise rival countries. This article gives a brief history of counterfeiting, with a particular focus on Australia, highlighting selected incidents through time and the policy responses to them. For source material on Australia, we draw on Reserve Bank archives dating back to the early 1900s.

Cash Withdrawal Symptoms

Most Australians don't have to travel more than a few kilometres to deposit or withdraw cash. Cash use is declining, however, and with it the number of ATMs and other cash access points. This trend seems likely to continue. While it will probably have relatively little impact on those living in metropolitan areas, it is important that reasonable access to cash services is maintained for people in regional or remote locations as long as such access is needed.

Bank Fees in Australia

The Reserve Bank has conducted a survey on bank fees each year since 1997. Banks' overall income from fees was little changed in 2018. The removal of ATM withdrawal fees by a number of banks reduced total fees charged to households. However, this was largely offset by the continued increase in fee income from small businesses, reflecting strong growth in credit card and debit card transactions.

Cryptocurrency: Ten Years On

Ten years on from the creation of Bitcoin, the term ‘cryptocurrency' has entered the public consciousness. Despite achieving some name recognition, cryptocurrencies are not widely used for payments. This article examines why Bitcoin is unlikely to become a ubiquitous payment method in Australia, and summarises how subsequent cryptocurrencies have sought to address some of the shortcomings of Bitcoin – such as its volatility and scalability problems. It also examines the proliferation of new ‘coins' and concludes that, despite the developments in cryptocurrencies, none are currently functioning as money in the economy.

Recent Trends in Banknote Counterfeiting

Law enforcement intervention has shut down several large counterfeiting operations and led to a decline in counterfeiting rates over the past couple of years. At the same time, the increased availability of low-cost, high-quality printing technology has meant that the quality of counterfeits has improved. This article discusses trends in banknote counterfeiting in Australia and the impact of counterfeiting on different stakeholders.

New Payments Insights from the Updated Retail Payments Statistics Collection

The Reserve Bank has significantly expanded the retail payments data that it publishes from 61 to around 300 series. This followed a project conducted in consultation with the industry to update the underlying statistical collection. The new data provide additional insights into Australians' payment behaviours, particularly in the context of the shift towards electronic methods of payment away from cash and cheques. This article discusses some of the new series being published by the Bank.

Understanding Demand for Australia's Banknotes

As the sole issuer of the nation's banknotes, the Reserve Bank knows how many banknotes it prints, issues to the public and destroys. However, much less is known about how these banknotes are used. This is particularly true for the $50 and $100 banknotes, which, by value, account for more than 90 per cent of banknotes on issue. To help address this, we describe in this article the various components of Australian cash demand and use a range of techniques to estimate how much each category contributes to total demand. Our key findings include that non-transactional demand for cash (e.g. hoarding for store-of-value purposes) has likely been the driving force of recent growth in the value of outstanding banknotes, and that a small but non-trivial portion of cash demand comes from the shadow economy.

Payment Surcharges: Economics, Regulation and Enforcement

The Reserve Bank's new rules on surcharging, which are enforced by the Australian Competition and Consumer Commission (ACCC), allow businesses to recover the cost of accepting different payment methods but prevent them from surcharging excessively. This article discusses the economic reasons for allowing businesses to surcharge, how the rules work to prevent excessive surcharging, the effect of these rules since their introduction, and how the ACCC enforces them.

The New Payments Platform and Fast Settlement Service

A significant advance in the Australian payments system occurred in February 2018 with the public launch of the New Payments Platform (NPP). The NPP enables customers of financial institutions to make immediate payments 24 hours a day, every day of the week (‘24/7’). In conjunction with the development of the NPP, the Reserve Bank developed new infrastructure, the Fast Settlement Service (FSS), which provides for settlement of NPP transactions between financial institutions on a 24/7 basis across their Exchange Settlement Accounts (ESAs) at the Reserve Bank. These new systems have brought fast payment services to Australians in line with similar initiatives that have been undertaken or are underway internationally. The initial adoption of the NPP has been gradual, reflecting the staged introduction of services by financial institutions, as well as the time taken for customers to assess and adjust to the new services being offered.

High-denomination Banknotes in Circulation: A Cross-country Analysis

In Australia, Canada and the United Kingdom, the number of high-denomination banknotes in circulation has increased at an above-trend rate in recent years. Evidence suggests that overseas demand might be a common driver of this elevated growth. Increased domestic demand for both transaction and store-of-value purposes may also have contributed, as well as responses to changes in government and central bank policies. This research was undertaken with assistance from members of the Four Nations Distribution Working Group, in line with the group's objective to explore banknote-related topics that are directly relevant to the member central banks.

The Reserve Bank's Collateral Framework

The Reserve Bank, like other central banks, holds collateral to reduce the risk of financial loss in its domestic market operations. The Reserve Bank's collateral framework sets out how the diverse portfolio of collateral assets is managed and ensures that collateral of sufficient quality and value is held at all times. Over the past two decades, the framework has been adjusted to address changes in collateral supply, changes in market functioning during the global financial crisis, payment system innovations and new banking regulations. This article explores the rationale for these changes and discusses the key features of the current framework.

Recent Developments in the ATM Industry

The ATM industry in Australia is undergoing a number of changes. Use of ATMs has been declining as people use cash less often for their transactions, though the number of ATMs remains at a high level. The total amount spent on ATM fees has fallen, and is likely to decline further as a result of recent decisions by a number of banks to remove their ATM direct charges. This article discusses the implications of these changes for the competitive landscape and the future size and structure of the industry.

The Growing Demand for Cash

While survey data indicate that the share of Australian consumers' payments made with cash continues to fall, the number (and value) of banknotes in circulation continues to grow at around its trend pace of 6 per cent per year. This article discusses the reasons for these diverging trends, including: population, inflation and real income growth; a slower decline in total (rather than relative) cash payments; high cash users not captured by survey data; and the increasing stock of banknotes held for non-transactional purposes.

Banking Fees in Australia

The Reserve Bank has conducted an annual survey on bank fees since 1997. The most recent survey suggests that banks' aggregate fee income increased at a relatively slow pace in 2016. Deposit and loan fee income continued to decline relative to the value of products on which these fees are levied. Greater use of electronic payment methods continued to support moderate growth in credit card and merchant service fee income.

The Ongoing Decline of the Cheque System

Cheque use in Australia has declined significantly over the past few decades and currently represents only a small share of non-cash payments. This decline reflects changes in the payments market as a result of technological change and customer preferences for faster, digital payments. To ensure that the payment needs of individuals and businesses continue to be met, the payments industry has embarked on a number of initiatives to manage the decline in cheque use.

How Australians Pay: New Survey Evidence

The Reserve Bank's 2016 Consumer Payments Survey showed that Australian consumers are increasingly using their debit or credit cards instead of paying in cash or writing cheques. While more and more small payments are being made with contactless ‘tap and go’ cards, cash is still often used for lower-value transactions and accounts for a significant share of payments for some segments of the community.

Recent Trends in Banknote Counterfeiting

Counterfeiting banknotes is a crime under Australian law. Although counterfeiting in Australia remains modest by international standards, the rate of counterfeiting has been rising in recent years as counterfeiters have increasingly taken advantage of developments in printing and copying. To ensure that counterfeiting remains low and banknotes remain a secure payment method, the Reserve Bank of Australia is issuing a new series of banknotes with upgraded security features. This article discusses trends highlighted by the Reserve Bank's ongoing monitoring and analysis of banknote counterfeiting activity in Australia.

The Cash Market

The cash market is the market for unsecured, overnight loans between banks. The weighted average of interest rates on these loans is the cash rate, the Reserve Bank's operational target for monetary policy and an important financial benchmark. Over the past decade or so there have been a number of regulatory and payment system developments that have affected the cash market, coinciding with a decline in aggregate market turnover. This article examines these developments using newly available data on payment system activity.

The Future of Cash

Australian consumers have increasingly been using electronic payment methods in preference to cash for their transactions. The overall demand for cash in Australia, however, remains strong. There is ongoing demand for cash for non-transaction purposes, particularly as a store of wealth. While the role of cash in society is evolving, it is likely to remain an important feature of the payments system and economy for the foreseeable future. Moreover, the current mix of banknote denominations continues to meet community demand for a secure means of payment and store of wealth. Given the ongoing importance of cash, the Reserve Bank will maintain the public's confidence in Australia's banknotes by continuing to ensure that banknotes are of high quality and secure from counterfeiting.

New Banknotes: From Concept to Circulation

A core function of the Reserve Bank is to maintain public confidence in Australia's banknotes as a secure method of payment and store of wealth. To meet this objective, the Reserve Bank has been developing a new banknote series to upgrade the security of Australia's banknotes. The process has involved integrating artistic designs that reflect Australia's cultural identity with a range of complex technical features designed to make the banknotes very difficult to counterfeit. This article outlines the various steps of the process of ‘banknotisation’ for the new banknote series, whereby the design concept is developed into a finished banknote.

Banking Fees in Australia

The Reserve Bank has conducted a survey on bank fees each year since 1997. The results of the most recent survey suggest that banks' fee income from both households and businesses rose in 2015, due to a combination of balance sheet growth and higher unit fees on some products. Deposit and loan fees have continued to decline as a ratio to the outstanding value of deposits and assets, respectively.

The ATM System since the 2009 Reforms

The past seven years have seen two major forces affecting the ATM system. Reforms to pricing arrangements in 2009 have had a number of effects, including establishing an environment that has encouraged a rise in ATM numbers. More recently, the ATM industry has been affected by a shift in consumer preferences towards payment cards, which has seen a decline in cash use and a resulting fall in the demand for ATM services. This article examines how activity and pricing in the ATM system have evolved since 2009. It finds that while ATM transactions are declining, ATM numbers at this stage continue to increase overall. ATM direct charges have risen slightly in real terms, but the number of withdrawals on which a fee is charged has fallen significantly.

CCPs and Banks: Different Risks, Different Regulations

Recent debate on the adequacy of regulatory standards for central counterparties (CCPs) has often drawn on the experience of bank regulation. This article draws out the essential differences between CCPs and banks, considering the implications of these differences for the regulatory approach. It argues that banks and CCPs affect systemic stability in different ways, with a CCP's systemic importance largely derived from its central role and a bank's systemic importance typically derived from the size and breadth of its activities. Any refinements to regulatory standards for CCPs that are drawn from bank regulation should not overlook these differences.

Banknote Stakeholder Engagement

The Reserve Bank has a responsibility to ensure confidence in Australia's banknotes as a secure method of payment and a store of wealth. One of the ways in which the Bank does this is by providing education and training to people who handle cash regularly in their jobs, and the public in general, so that they can easily check the authenticity of their banknotes. In the lead-up to the next generation of Australian banknotes, this work will be crucial to ensure public confidence in the new banknote series. It is also important to engage with key stakeholders who produce and use machines that will accept the new banknotes. This article outlines the work that the Bank has undertaken to establish suitable communication channels and engage with key stakeholders in preparation for the Next Generation Banknote (NGB) program.

The Life of Australian Banknotes

An assessment of the likely life of a banknote is an important input to a currency issuer's planning. Without accurate predictions of banknote life, there is the potential to incur the economic costs of producing and storing excess banknotes or, conversely, in an extreme case, of not being able to meet the public's demand. The life of a banknote, however, is not directly observed and must be estimated. This article discusses some traditional measures of banknote life and provides some alternative estimates using ‘survival’ modelling.

Banking Fees in Australia

The Reserve Bank has conducted a survey on bank fees each year since 1997. The results of the most recent survey suggest that banks' fee income from both households and businesses rose moderately in 2014, predominantly as a result of balance sheet growth, rather than increases in fees on loans or deposits. Overall, developments in banks' fee income followed similar patterns to 2013.

Skin in the Game – Central Counterparty Risk Controls and Incentives

The increasing systemic importance of central counterparties (CCPs) has seen recent policy debates focus on the ability of CCPs to withstand a crisis effectively. CCPs maintain prefunded financial resources to cover the potential losses arising from the default of a clearing participant. This article discusses the incentives created by the composition of these resources, and draws out the role of transparency and governance in ensuring these incentives are effective.

Australian Banknotes: Assisting People with Vision Impairment

A key function of the Reserve Bank is to design and produce banknotes that meet the needs of all sections of the community. The Bank has consulted a wide range of subject matter experts and stakeholders to ensure that the next generation of Australia's banknotes reflects Australia's cultural identity, is secure and remains functional. One aspect of functionality is that the banknotes are accessible to people with vision impairment. This article outlines the work the Bank has undertaken to meet the needs of the vision-impaired community, from the paper decimal banknote series that was issued in 1966 through to the forthcoming next generation series of banknotes.

The Equity Securities Lending Market

An equity securities loan is an arrangement in which one party (the lender) agrees to transfer an equity security to another party (the borrower) temporarily, usually in exchange for collateral and a fee. The market for securities loans is an important component of Australia's equity market and contributes to its efficiency and smooth functioning. Regulatory developments since the global financial crisis are contributing to significant changes to the equity securities lending market globally, including in Australia. This article discusses some of these changes and how participants in the market could respond.

Fast Retail Payment Systems

In December 2014, a group of Australian financial institutions announced that funding had been secured for the next phase of the New Payments Platform (NPP), which will provide the capability for Australian consumers and businesses to make and receive payments in near to real time. The NPP is one example of a fast retail payment system, a number of which have been implemented in other countries in recent years. This article provides an overview of some of the features of fast payment systems and discusses the approach taken in the design of the NPP.

The Effective Supply of Collateral in Australia

High-quality assets play an important role as collateral for a wide range of transactions and activities in wholesale financial markets. Regulatory changes since the global financial crisis are increasing the demand for high-quality assets, thereby raising concerns about possible collateral shortages. This article attempts to quantify the ‘effective’ supply of collateral assets in Australia by using a measure of supply that adjusts outstanding issuance for two important features of the collateral market. One feature is that a large proportion of Australian high-quality assets is held by long-term investors that do not make these assets available for sale, loan or use in repurchase agreements. A second feature is the ability to re-use collateral assets, thereby allowing a single piece of collateral to meet multiple demands. Using a new survey that adjusts for these features, the current effective supply of Australian government debt for collateral purposes is estimated to be around $128 billion, comprising around $80 billion of active supply that is re-used on average 1.6 times. This amount would appear to be sufficient to support current demand for collateral.

Banking Fees in Australia

The Reserve Bank has conducted a survey on bank fees each year since 1997. The results of the most recent survey suggest that banks' fee income from both households and businesses rose moderately in 2013. However, deposit and loan fees have declined as a ratio to the outstanding values of deposits and assets, respectively.

Cash Use in Australia

This article uses results from the 2013 Survey of Consumers' Use of Payment Methods and regression analysis to examine trends in cash use in Australia. The results show that cash remained the most common form of payment, though its use relative to other payment methods has declined over recent years. Older participants were more likely to use cash than younger participants and all participants were more likely to use cash for low-value transactions relative to other payment methods. In addition, participants were asked about their holdings of banknotes in their ‘wallet’ (i.e. on their person) and elsewhere, with the results suggesting that cash – particularly high-value denominations – was being used as a store of value and not just for transactional purposes.

The Introduction of Same-day Settlement of Direct Entry Obligations in Australia

In November 2013, the Reserve Bank introduced changes to its Reserve Bank Information and Transfer System (RITS) to allow the same-day settlement of non-government direct entry obligations. This outcome met one of the objectives set by the Payments System Board in its June 2012 Strategic Review of Innovation in the Payments System. The changes provide a platform for greater efficiency and innovation in Australia's payments system, potentially allowing faster access to funds, and reducing the key risks associated with deferred settlement. The support of the Australian Payments Clearing Association (APCA) and the banking industry was critical in the successful development and implementation of the new settlement arrangements. The transition to the new arrangements has progressed smoothly, with the vast bulk of customers' direct entry transactions, around $16.5 billion, now settled on a same-day basis each business day.

The Next Generation Banknote Project

A core function of the Reserve Bank is to maintain public confidence in the nation's banknotes so that they remain an effective means of payment and a secure store of wealth. This article discusses the Bank's counterfeit deterrence strategy and the central role that the Next Generation Banknote (NGB) project will play in this strategy by enhancing the security of Australia's banknotes.

Non-dealer Clearing of Over-the-counter Derivatives

In 2009, the G20 leaders agreed that all standardised over-the-counter (OTC) derivatives should be cleared through central counterparties (CCPs). Accordingly, an increasing proportion of OTC derivatives are now centrally cleared, particularly where the trading counterparties are large ‘dealer’ firms. However, for many smaller financial institutions and non-financial corporations, there remain material challenges in adopting central clearing. Such firms usually access CCPs indirectly through arrangements with larger dealer firms – so-called ‘client clearing’ arrangements. While non-dealers have long used such arrangements for their exchange-traded activity, increased CCP clearing of OTC derivative products has prompted market participants and policymakers to examine more closely these arrangements. Aspects of the design of client clearing arrangements, such as collateral requirements, operating schedules, and the degree of segregation of positions and collateral, can all have material implications for the costs and risks a firm faces in its OTC derivative trading activity. Some of these aspects could also have broader implications for financial stability.

Recovery and Resolution of Central Counterparties

The increasing importance of central counterparties (CCPs) to financial stability has prompted regulators to take steps to ensure that critical CCP services can continue in circumstances of financial distress. These steps include ensuring that CCPs have robust plans for recovery to return them to viability, and that authorities have the ability to resolve a CCP if required. This article discusses the key components that are expected to form part of CCPs' recovery plans, including the power of a CCP to apply ‘haircuts’ to variation margin payments. The article also notes the potential elements that may form part of a resolution regime for CCPs.

Banking Fees in Australia

The Reserve Bank has conducted a survey on bank fees each year since 1997. The results of the most recent survey suggest that banks' fee income from households continued to decline in 2012, but fee income from businesses increased substantially.

OTC Derivatives Reforms and the Australian Cross-currency Swap Market

Reforms to improve the management of counterparty credit risk in over-the-counter (OTC) derivatives markets are underway globally. A key pillar of the reforms is the migration of these markets to central counterparties (CCPs), while higher capital charges and increased collateralisation will apply to derivatives that remain non-centrally cleared. One class of OTC derivatives that could be significantly affected by these reforms are cross-currency swaps. These instruments are particularly important to the Australian financial system because Australian banks raise a significant proportion of their funding by issuing foreign currency bonds in offshore markets and using cross-currency swaps to hedge the associated foreign exchange (FX) risk. No CCP yet offers a central clearing solution for cross-currency swaps, which means that Australian banks will continue to manage counterparty credit risk in this market on a bilateral basis for the time being. Regardless of whether cross-currency swaps are centrally or non-centrally cleared, it is important when implementing the reforms in this market to examine how market participants will adjust to the new environment.

The graphs in the Bulletin were generated using Mathematica.

ISSN 1837-7211 (Online)