June 2021

- Download the complete Bulletin 9.90MB

COVID-19 Stimulus Payments and the Reserve Bank’s Transactional Banking Services

The Australian Government introduced significant fiscal support measures to limit the negative economic effects of the COVID-19 pandemic and support economic recovery. In its capacity as the banker to the Commonwealth of Australia, and importantly as transactional banker to the large agencies charged with delivering a number of these measures, the Reserve Bank facilitated the distribution of fiscal stimulus payments to households and businesses. Improvements in government processes to ensure bank account details are available when delivering large-scale economic stimulus programs ensured that the COVID-19 stimulus payments were delivered more quickly and efficiently when compared to the stimulus payments made during the Global Financial Crisis (GFC) in 2008 and 2009. This meant that there was little delay for the economic stimulus to be available to the recipients and the economic support to take effect.

How Far Do Australians Need to Travel to Access Cash?

Our analysis finds that Australians generally do not have to travel far to reach their nearest cash access point – a location where they may make cash withdrawals and/or deposits. Around 95 per cent of people live within about 5 kilometres of a cash access point, broadly unchanged since 2017. However, there are parts of regional and remote Australia with limited access to cash. People in these areas must travel longer distances to access cash, and the available access points do not always have nearby alternatives. This means that access to cash in these areas is more vulnerable to any future removal of cash services.

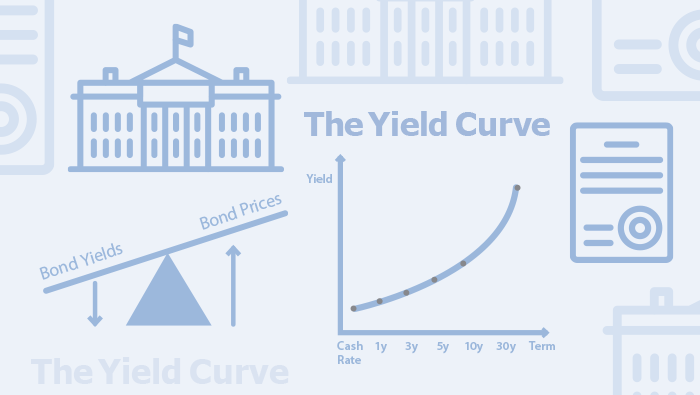

An Initial Assessment of the Reserve Bank's Bond Purchase Program

This article provides an initial assessment of the effect of the Reserve Bank's bond purchase program on government bond yields. Overall, we estimate that the program has reduced longer-term Australian Government Security (AGS) yields by around 30 basis points and lowered the spread of state and territory bond yields to AGS yields by 5 to 10 basis points, relative to where they would otherwise have been. This reduction in yields occurred partly in anticipation of the program and partly at its announcement. Bond yields have risen noticeably since the program was announced, but this does not imply that the impact of the program was transitory: many factors contribute to changes in bond yields, and our assessment is that bond purchases serve to hold yields lower than they would otherwise have been over an extended period. The bond purchase program has not had any substantial negative impact on the functioning of government bond markets.

Monetary Policy, Liquidity, and the Central Bank Balance Sheet

In response to the COVID-19 pandemic, the Reserve Bank deployed a number of monetary policy tools, including some new measures, to support the economy and address disruptions to the smooth functioning of financial markets. This new mix of policy tools has changed how the Reserve Bank implements monetary policy, and has significantly increased the size of the Bank's balance sheet and the amount of liquidity in the banking system.

The Committed Liquidity Facility

The Reserve Bank provides the Committed Liquidity Facility (CLF) to enhance the resilience of the banking system in times of liquidity stress. Banks need to hold high-quality liquid assets (HQLA), including government securities, as a buffer against liquidity stress. However the low level of government debt in Australia limited the amount they could reasonably hold. The CLF was introduced in 2015 as an alternative. Since 2019, the size of the CLF has been reduced because the amount of government debt on issue has increased significantly. The fee charged for access to the CLF has also been increased to ensure that banks have an incentive to manage their liquidity risk appropriately. The size of the CLF and the associated fee have been adjusted in a measured way to ensure a smooth transition.

Corporate Bonds in the Reserve Bank's Collateral Framework

In May 2020, the Reserve Bank broadened the range of corporate bonds accepted as collateral under repurchase agreements (repo) from AAA-rated to investment grade (BBB- or above). This change in policy increased the universe of potentially eligible securities for domestic market operations by around $150 billion, of which the Reserve Bank has received applications for and granted eligibility to around $50 billion. In assessing applications for repo eligibility, a number of features – including subordination, embedded options and legal risks – required further investigation to ensure the securities remained within the Bank's risk appetite. Corporate securities remain a small share of total eligible collateral. While usage of corporate bonds in repos with the Bank has been relatively modest to date, the policy change to broaden may have provided some support to the Australian corporate bond market.

Review of the NGB Upgrade Program

A key responsibility of the Reserve Bank is to maintain public confidence in Australia's banknotes as a secure method of payment and store of wealth. To help achieve this objective the Bank initiated the Next Generation Banknote (NGB) program, which involved the design and development of a new banknote series to make Australia's banknotes more secure from counterfeiting. The decade-long program concluded in late 2020, with the release of the final upgraded banknote into general circulation. The program delivered a suite of new Australian banknotes with a range of new innovative security features. Overall the banknotes have been well received by the general public and counterfeiting rates have remained low.

The Transition from High School to University Economics

To promote economic literacy and ensure the long-term health of the economics discipline, it is important to address the sharp decline in the size and diversity of the economics student population. Administrative data from the University Admissions Centre (UAC) provides information about how students transition from high school to university economics. These pathways suggest that interventions to increase the number and diversity of students studying economics in Year 12 can strengthen the pipeline of students into university economics. Interventions to improve the economic literacy of Year 12 economics students who are less socially advantaged are important to encourage more diversity in university economics; in contrast, female students appear to need less academic support and may instead benefit more from tailored interventions that pique their interest in and confidence with economics. More advocacy of economics should also increase its uptake at university, particularly among students already studying economics and/or a STEM subject in Year 12 and higher performers.

Bank Fees in Australia During the COVID-19 Pandemic

The Reserve Bank's annual survey of bank fees shows that their fee income from both households and businesses in Australia declined notably over 2020 due to the disruption to economic activity caused by the COVID-19 pandemic.

Low Interest Rates and Bank Profitability – The International Experience So Far

This article discusses the effect that low interest rates may have on bank profits, and reviews the experience of banks in economies that have had very low interest rates for an extended period. In the short to medium run, low or negative interest rates appear to reduce bank profits only a little, after accounting for the positive effects of lower interest rates on loan losses and demand for credit. However, the negative effects on bank profits increase when interest rates remain very low for a prolonged period. The profits of smaller banks – which have more household deposits, limited pricing power or less capacity to adjust their activities – are more sensitive to a prolonged period of low interest rates.

Underemployment in the Australian Labour Market

Underemployment in Australia has been moving higher for several decades. This article reviews the trends that have been driving this, including the long-run increase in part-time employment and changes in how the labour market adjusts to fluctuations in labour demand. The article also discusses the implications of the upwards trend in the underemployment rate for assessing spare capacity in the labour market. One implication is that the unemployment rate may need to decline by more than has previously been the case before wage pressures start building strongly.

The Global Fiscal Response to COVID-19

Globally, the fiscal policy response to the COVID-19 crisis has been the largest and fastest in peacetime. Governments have prioritised direct fiscal support for private incomes and employment, which has limited economic scarring and established a solid foundation for the recovery. The size and composition of the fiscal response has varied across countries, reflecting differences in automatic stabilisers, pre-pandemic fiscal space, the severity of infections and policy preferences. Fiscal policy is likely to remain supportive for some time after the pandemic subsides, and in many countries is expected to focus increasingly on boosting investment. For as long as governments anchor spending decisions in a sound medium-term fiscal framework and interest rates remain lower than the rate of economic growth, ongoing fiscal support need not pose problems for government debt sustainability.

Examining the Causes of Historical Failures of Central Counterparties

Although historically rare, the failure of a central counterparty (CCP) could severely disrupt and destabilise the financial system. This has driven a global push to implement resolution regimes so that authorities can support the continuity of critical functions of a distressed CCP. This article examines 3 CCP failures to identify common causes of failure that could help authorities prevent or prepare for a resolution. It finds that while there are some common causes of failure in the episodes considered, they have largely been addressed by improvements in CCP financial risk management in recent years.

The graphs in the Bulletin were generated using Mathematica.

ISSN 1837-7211 (Online)